Gross domestic product

Gross domestic product (GDP) refers to the market value of all final goods and services produced within a country in a given period. GDP per capita is often considered an indicator of a country's standard of living;[2][3] although this can be problematic because GDP per capita is not a measure of personal income. See Standard of living and GDP.

Gross domestic product is related to national accounts, a subject in macroeconomics.

Contents |

History

GDP was first developed by Simon Kuznets for a US Congress report in 1934,[4] who immediately said not to use it as a measure for welfare (see below under limitations).

Determining GDP

| Economics |

|

Economies by region

|

| General categories |

|---|

|

History of economic thought Methodology · Mainstream & heterodox |

| Technical methods |

|

Game theory · Optimization Computational · Econometrics Experimental · National accounting |

| Fields and subfields |

|

Behavioral · Cultural · Evolutionary |

| Lists |

|

Journals · Publications |

| Business and Economics Portal |

GDP can be determined in three ways, all of which should, in principle, give the same result. They are the product (or output) approach, the income approach, and the expenditure approach.

The most direct of the three is the product approach, which sums the outputs of every class of enterprise to arrive at the total. The expenditure approach works on the principle that all of the product must be bought by somebody, therefore the value of the total product must be equal to people's total expenditures in buying things. The income approach works on the principle that the incomes of the productive factors ("producers," colloquially) must be equal to the value of their product, and determines GDP by finding the sum of all producers' incomes.[5]

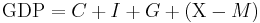

Example: the expenditure method:

- GDP = private consumption + gross investment + government spending + (exports − imports), or

Note: "Gross" means that GDP measures production regardless of the various uses to which that production can be put. Production can be used for immediate consumption, for investment in new fixed assets or inventories, or for replacing depreciated fixed assets. "Domestic" means that GDP measures production that takes place within the country's borders. In the expenditure-method equation given above, the exports-minus-imports term is necessary in order to null out expenditures on things not produced in the country (imports) and add in things produced but not sold in the country (exports).

Economists (since Keynes) have preferred to split the general consumption term into two parts; private consumption, and public sector (or government) spending. Two advantages of dividing total consumption this way in theoretical macroeconomics are:

- Private consumption is a central concern of welfare economics. The private investment and trade portions of the economy are ultimately directed (in mainstream economic models) to increases in long-term private consumption.

- If separated from endogenous private consumption, government consumption can be treated as exogenous, so that different government spending levels can be considered within a meaningful macroeconomic framework.

Production approach

" Market value of all final goods and services calculated during 1 year . "

The production approach is also called as Net Product or Value added method. This method consists of three stages:

- Estimating the Gross Value of domestic Output in various economic activities;

- Determining the intermediate consumption, i.e., the cost of material, supplies and services used to produce final goods or services; and finally

- Deducting intermediate consumption from Gross Value to obtain the Net Value of Domestic Output.

Symbolically,

Gross Value Added = Value of output – Value of Intermediate Consumption.

Value of Output = Value of the total sales of goods and services + Value of changes in the inventories.

The sum of Gross Value Added in various economic activities is known as GDP at factor cost.

GDP at factor cost plus indirect taxes less subsidies on products is GDP at Producer Price.

For measuring gross output of domestic product, economic activities (i.e. industries) are classified into various sectors. After classifying economic activities, the gross output of each sector is calculated by any of the following two methods:

- By multiplying the output of each sector by their respective market price and adding them together and

- By collecting data on gross sales and inventories from the records of companies and adding them together.

Subtracting each sector's intermediate consumption from gross output, we get sectoral Gross Value Added (GVA) at factor cost. We, then add gross value of all sectors to get GDP at factor cost. Adding indirect tax less subsidies in GDP at factor cost, we get GDP at Producer Prices.

Income approach

" sum total of incomes of individual living in a country during 1 year ."

Another way of measuring GDP is to measure total income. If GDP is calculated this way it is sometimes called Gross Domestic Income (GDI), or GDP(I). GDI should provide the same amount as the expenditure method described above. (By definition, GDI = GDP. In practice, however, measurement errors will make the two figures slightly off when reported by national statistical agencies.)

This method measures GDP by adding incomes that firms pay households for factors of production they hire- wages for labour, interest for capital, rent for land and profits for entrepreneurship.

The US "National Income and Expenditure Accounts" divide incomes into five categories:

- Wages, salaries, and supplementary labour income

- Corporate profits

- Interest and miscellaneous investment income

- Farmers’ income

- Income from non-farm unincorporated businesses

These five income components sum to net domestic income at factor cost.

Two adjustments must be made to get GDP:

- Indirect taxes minus subsidies are added to get from factor cost to market prices.

- Depreciation (or Capital Consumption Allowance) is added to get from net domestic product to gross domestic product.

Total income can be subdivided according to various schemes, leading to various formulae for GDP measured by the income approach. A common one is:

- GDP = compensation of employees + gross operating surplus + gross mixed income + taxes less subsidies on production and imports

- GDP = COE + GOS + GMI + TP & M – SP & M

- Compensation of employees (COE) measures the total remuneration to employees for work done. It includes wages and salaries, as well as employer contributions to social security and other such programs.

- Gross operating surplus (GOS) is the surplus due to owners of incorporated businesses. Often called profits, although only a subset of total costs are subtracted from gross output to calculate GOS.

- Gross mixed income (GMI) is the same measure as GOS, but for unincorporated businesses. This often includes most small businesses.

The sum of COE, GOS and GMI is called total factor income; it is the income of all of the factors of production in society. It measures the value of GDP at factor (basic) prices. The difference between basic prices and final prices (those used in the expenditure calculation) is the total taxes and subsidies that the government has levied or paid on that production. So adding taxes less subsidies on production and imports converts GDP at factor cost to GDP(I).

Total factor income is also sometimes expressed as:

- Total factor income = Employee compensation + Corporate profits + Proprieter's income + Rental income + Net interest[6]

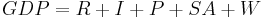

Yet another formula for GDP by the income method is:

where R : rents

I : interests

P : profits

SA : statistical adjustments (corporate income taxes, dividends, undistributed corporate profits)

W : wages

Note the mnemonic, "ripsaw".

Expenditure approach

" All expenditure incurred by individual during 1 year . "

In economics, most things produced are produced for sale, and sold. Therefore, measuring the total expenditure of money used to buy things is a way of measuring production. This is known as the expenditure method of calculating GDP. Note that if you knit yourself a sweater, it is production but does not get counted as GDP because it is never sold. Sweater-knitting is a small part of the economy, but if one counts some major activities such as child-rearing (generally unpaid) as production, GDP ceases to be an accurate indicator of production. Similarly, if there is a long term shift from non-market provision of services (for example cooking, cleaning, child rearing, do-it yourself repairs) to market provision of services, then this trend toward increased market provision of services may mask a dramatic decrease in actual domestic production, resulting in overly optimistic and inflated reported GDP. This is particularly a problem for economies which have shifted from production economies to service economies.

Components of GDP by expenditure

GDP (Y) is a sum of Consumption (C), Investment (I), Government Spending (G) and Net Exports (X – M).

- Y = C + I + G + (X − M)

Here is a description of each GDP component:

- C (consumption) is normally the largest GDP component in the economy, consisting of private (household final consumption expenditure) in the economy. These personal expenditures fall under one of the following categories: durable goods, non-durable goods, and services. Examples include food, rent, jewelry, gasoline, and medical expenses but does not include the purchase of new housing.

- I (investment) includes business investment in equipments for example and does not include exchanges of existing assets. Examples include construction of a new mine, purchase of software, or purchase of machinery and equipment for a factory. Spending by households (not government) on new houses is also included in Investment. In contrast to its colloquial meaning, 'Investment' in GDP does not mean purchases of financial products. Buying financial products is classed as 'saving', as opposed to investment. This avoids double-counting: if one buys shares in a company, and the company uses the money received to buy plant, equipment, etc., the amount will be counted toward GDP when the company spends the money on those things; to also count it when one gives it to the company would be to count two times an amount that only corresponds to one group of products. Buying bonds or stocks is a swapping of deeds, a transfer of claims on future production, not directly an expenditure on products.

- G (government spending) is the sum of government expenditures on final goods and services. It includes salaries of public servants, purchase of weapons for the military, and any investment expenditure by a government. It does not include any transfer payments, such as social security or unemployment benefits.

- X (exports) represents gross exports. GDP captures the amount a country produces, including goods and services produced for other nations' consumption, therefore exports are added.

- M (imports) represents gross imports. Imports are subtracted since imported goods will be included in the terms G, I, or C, and must be deducted to avoid counting foreign supply as domestic.

A fully equivalent definition is that GDP (Y) is the sum of final consumption expenditure (FCE), gross capital formation (GCF), and net exports (X – M).

- Y = FCE + GCF+ (X − M)

FCE can then be further broken down by three sectors (households, governments and non-profit institutions serving households) and GCF by five sectors (non-financial corporations, financial corporations, households, governments and non-profit institutions serving households). The advantage of this second definition is that expenditure is systematically broken down, firstly, by type of final use (final consumption or capital formation) and, secondly, by sectors making the expenditure, whereas the first definition partly follows a mixed delimitation concept by type of final use and sector.

Note that C, G, and I are expenditures on final goods and services; expenditures on intermediate goods and services do not count. (Intermediate goods and services are those used by businesses to produce other goods and services within the accounting year.[7] )

According to the U.S. Bureau of Economic Analysis, which is responsible for calculating the national accounts in the United States, "In general, the source data for the expenditures components are considered more reliable than those for the income components [see income method, below]."[8]

Examples of GDP component variables

C, I, G, and NX(net exports): If a person spends money to renovate a hotel to increase occupancy rates, the spending represents private investment, but if he buys shares in a consortium to execute the renovation, it is saving. The former is included when measuring GDP (in I), the latter is not. However, when the consortium conducted its own expenditure on renovation, that expenditure would be included in GDP.

If a hotel is a private home, spending for renovation would be measured as consumption, but if a government agency converts the hotel into an office for civil servants, the spending would be included in the public sector spending, or G.

If the renovation involves the purchase of a chandelier from abroad, that spending would be counted as C, G, or I (depending on whether a private individual, the government, or a business is doing the renovation), but then counted again as an import and subtracted from the GDP so that GDP counts only goods produced within the country.

If a domestic producer is paid to make the chandelier for a foreign hotel, the payment would not be counted as C, G, or I, but would be counted as an export.

A "production boundary" that delimits what will be counted as GDP.

"One of the fundamental questions that must be addressed in preparing the national economic accounts is how to define the production boundary–that is, what parts of the myriad human activities are to be included in or excluded from the measure of the economic production."[9]

All output for market is at least in theory included within the boundary. Market output is defined as that which is sold for "economically significant" prices; economically significant prices are "prices which have a significant influence on the amounts producers are willing to supply and purchasers wish to buy."[10] An exception is that illegal goods and services are often excluded even if they are sold at economically significant prices (Australia and the United States exclude them).

This leaves non-market output. It is partly excluded and partly included. First, "natural processes without human involvement or direction" are excluded.[11] Also, there must be a person or institution that owns or is entitled to compensation for the product. An example of what is included and excluded by these criteria is given by the United States' national accounts agency: "the growth of trees in an uncultivated forest is not included in production, but the harvesting of the trees from that forest is included."[12]

Within the limits so far described, the boundary is further constricted by "functional considerations."[13] The Australian Bureau for Statistics explains this: "The national accounts are primarily constructed to assist governments and others to make market-based macroeconomic policy decisions, including analysis of markets and factors affecting market performance, such as inflation and unemployment." Consequently, production that is, according to them, "relatively independent and isolated from markets," or "difficult to value in an economically meaningful way" [i.e., difficult to put a price on] is excluded.[14] Thus excluded are services provided by people to members of their own families free of charge, such as child rearing, meal preparation, cleaning, transportation, entertainment of family members, emotional support, care of the elderly.[15] Most other production for own (or one's family's) use is also excluded, with two notable exceptions which are given in the list later in this section.

Nonmarket outputs that are included within the boundary are listed below. Since, by definition, they do not have a market price, the compilers of GDP must impute a value to them, usually either the cost of the goods and services used to produce them, or the value of a similar item that is sold on the market.

- Goods and services provided by governments and non-profit organisations free of charge or for economically insignificant prices are included. The value of these goods and services is estimated as equal to their cost of production. This ignores the consumer surplus generated by an efficient and effective government supplied infrastructure. For example, government-provided clean water confers substantial benefits above its cost. Ironically, lack of such infrastructure which would result in higher water prices (and probably higher hospital and medication expenditures) would be reflected as a higher GDP. This may also cause a bias that mistakenly favors inefficient privatizations since some of the consumer surplus from privatized entities' sale of goods and services are indeed reflected in GDP.[16]

- Goods and services produced for own-use by businesses are attempted to be included. An example of this kind of production would be a machine constructed by an engineering firm for use in its own plant.

- Renovations and upkeep by an individual to a home that she owns and occupies are included. The value of the upkeep is estimated as the rent that she could charge for the home if she did not occupy it herself. This is the largest item of production for own use by an individual (as opposed to a business) that the compilers include in GDP.[16] If the measure uses historical or book prices for real estate, this will grossly underestimate the value of the rent in real estate markets which have experienced significant price increases (or economies with general inflation). Furthermore, depreciation schedules for houses often accelerate the accounted depreciation relative to actual depreciation (a well built house can be lived in for several hundred years – a very long time after it has been fully depreciated). In summary, this is likely to grossly underestimate the value of existing housing stock on consumers' actual consumption or income.

- Agricultural production for consumption by oneself or one's household is included.

- Services (such as chequeing-account maintenance and services to borrowers) provided by banks and other financial institutions without charge or for a fee that does not reflect their full value have a value imputed to them by the compilers and are included. The financial institutions provide these services by giving the customer a less advantageous interest rate than they would if the services were absent; the value imputed to these services by the compilers is the difference between the interest rate of the account with the services and the interest rate of a similar account that does not have the services. According to the United States Bureau for Economic Analysis, this is one of the largest imputed items in the GDP.[17]

GDP vs GNP

GDP can be contrasted with gross national product (GNP) or gross national income (GNI). The difference is that GDP defines its scope according to location, while GNP defines its scope according to ownership. In a global context, world GDP and world GNP are, therefore, equivalent terms.

GDP is product produced within a country's borders; GNP is product produced by enterprises owned by a country's citizens. The two would be the same if all of the productive enterprises in a country were owned by its own citizens, and those citizens did not own productive enterprises in any other countries. In practice, however, foreign ownership makes GDP and GNP non-identical. Production within a country's borders, but by an enterprise owned by somebody outside the country, counts as part of its GDP but not its GNP; on the other hand, production by an enterprise located outside the country, but owned by one of its citizens, counts as part of its GNP but not its GDP.

To take the United States as an example, the U.S.'s GNP is the value of output produced by American-owned firms, regardless of where the firms are located. Similarly, if a country becomes increasingly in debt, and spends large amounts of income servicing this debt this will be reflected in a decreased GNI but not a decreased GDP. Similarly, if a country sells off its resources to entities outside their country this will also be reflected over time in decreased GNI, but not decreased GDP. This would make the use of GDP more attractive for politicians in countries with increasing national debt and decreasing assets.

Gross national income (GNI) equals GDP plus income receipts from the rest of the world minus income payments to the rest of the world.[18]

In 1991, the United States switched from using GNP to using GDP as its primary measure of production.[19] The relationship between United States GDP and GNP is shown in table 1.7.5 of the National Income and Product Accounts.[20]

International standards

The international standard for measuring GDP is contained in the book System of National Accounts (1993), which was prepared by representatives of the International Monetary Fund, European Union, Organization for Economic Co-operation and Development, United Nations and World Bank. The publication is normally referred to as SNA93 to distinguish it from the previous edition published in 1968 (called SNA68) [21]

SNA93 provides a set of rules and procedures for the measurement of national accounts. The standards are designed to be flexible, to allow for differences in local statistical needs and conditions.

National measurement

Within each country GDP is normally measured by a national government statistical agency, as private sector organizations normally do not have access to the information required (especially information on expenditure and production by governments).

Interest rates

Net interest expense is a transfer payment in all sectors except the financial sector. Net interest expenses in the financial sector are seen as production and value added and are added to GDP.

Nominal GDP and Adjustments to GDP

The raw GDP figure as given by the equations above is called the Nominal, or Historical, or Current, GDP. When comparing GDP figures from one year to another, it is desirable to compensate for changes in the value of money – i.e., for the effects of inflation or deflation. To make it more meaningful for year-to-year comparisons, it may be multiplied by the ratio between the value of money in the year the GDP was measured and the value of money in some base year. For example, suppose a country's GDP in 1990 was $100 million and its GDP in 2000 was $300 million; but suppose that inflation had halved the value of its currency over that period. To meaningfully compare its 2000 GDP to its 1990 GDP we could multiply the 2000 GDP by one-half, to make it relative to 1990 as a base year. The result would be that the 2000 GDP equals $300 million × one-half = $150 million, in 1990 monetary terms. We would see that the country's GDP had, realistically, increased 50 percent over that period, not 200 percent, as it might appear from the raw GDP data. The GDP adjusted for changes in money-value in this way is called the Real, or Constant, GDP.

The factor used to convert GDP from current to constant values in this way is called the GDP deflator. Unlike the Consumer price index, which measures inflation or deflation in the price of household consumer goods, the GDP deflator measures changes in the prices of all domestically produced goods and services in an economy–including investment goods and government services, as well as household consumption goods.[22]

Constant-GDP figures allow us to calculate a GDP growth rate, which tells us how much a country's production has increased (or decreased, if the growth rate is negative) compared to the previous year.

- Real GDP growth rate for year n = [(Real GDP in year n) − (Real GDP in year n − 1)] / (Real GDP in year n − 1)

Another thing that it may be desirable to compensate for is population growth. If a country's GDP doubled over some period but its population tripled, the increase in GDP may not be deemed such a great accomplishment: the average person in the country is producing less than they were before. Per-capita GDP is the measure compensated for population growth.

Cross-border comparison and PPP

The level of GDP in different countries may be compared by converting their value in national currency according to either the current currency exchange rate, or the purchase power parity exchange rate.

- Current currency exchange rate is the exchange rate in the international currency market.

- Purchasing power parity exchange rate is the exchange rate based on the purchasing power parity (PPP) of a currency relative to a selected standard (usually the United States dollar). This is a comparative (and theoretical) exchange rate, the only way to directly realize this rate is to sell an entire CPI basket in one country, convert the cash at the currency market rate & then rebuy that same basket of goods in the other country (with the converted cash). Going from country to country, the distribution of prices within the basket will vary; typically, non-tradable purchases will consume a greater proportion of the basket's total cost in the higher GDP country, per the Balassa-Samuelson effect.

The ranking of countries may differ significantly based on which method is used.

- The current exchange rate method converts the value of goods and services using global currency exchange rates. The method can offer better indications of a country's international purchasing power and relative economic strength. For instance, if 10% of GDP is being spent on buying hi-tech foreign arms, the number of weapons purchased is entirely governed by current exchange rates, since arms are a traded product bought on the international market. There is no meaningful 'local' price distinct from the international price for high technology goods.

- The purchasing power parity method accounts for the relative effective domestic purchasing power of the average producer or consumer within an economy. The method can provide a better indicator of the living standards of less developed countries, because it compensates for the weakness of local currencies in the international markets. For example, India ranks 11th by nominal GDP, but fourth by PPP. The PPP method of GDP conversion is more relevant to non-traded goods and services.

There is a clear pattern of the purchasing power parity method decreasing the disparity in GDP between high and low income (GDP) countries, as compared to the current exchange rate method. This finding is called the Penn effect.

For more information, see Measures of national income and output.

Per unit GDP

GDP is an aggregate figure which does not consider differing sizes of nations. Therefore, GDP can be stated as GDP per capita (per person) in which total GDP is divided by the resident population on a given date, GDP per citizen where total GDP is divided by the numbers of citizens residing in the country on a given date, and less commonly GDP per unit of a resource input, such as GDP per GJ of energy or Gross domestic product per barrel. GDP per citizen in the above case is pretty similar to GDP per capita in most nations, however, in nations with very high proportions of temporary foreign workers like in Persian Gulf nations, the two figures can be vastly different.

Standard of living and GDP

GDP per capita is not a measurement of the standard of living in an economy. However, it is often used as such an indicator, on the rationale that all citizens would benefit from their country's increased economic production. Similarly, GDP per capita is not a measure of personal income. GDP may increase while real incomes for the majority decline. The major advantage of GDP per capita as an indicator of standard of living is that it is measured frequently, widely, and consistently. It is measured frequently in that most countries provide information on GDP on a quarterly basis, allowing trends to be seen quickly. It is measured widely in that some measure of GDP is available for almost every country in the world, allowing inter-country comparisons. It is measured consistently in that the technical definition of GDP is relatively consistent among countries.

The major disadvantage is that it is not a measure of standard of living. GDP is intended to be a measure of total national economic activity—a separate concept.

The argument for using GDP as a standard-of-living proxy is not that it is a good indicator of the absolute level of standard of living, but that living standards tend to move with per-capita GDP, so that changes in living standards are readily detected through changes in GDP.

Externalities

GDP is widely used by economists to gauge economic recession and recovery and an economies general monetary ability address externalites. Its not meant to measure externalities. Its serves as a general metric for a nominal monetary standard of living and is not adjusted for costs of living within a region. GDP is a neutral measure which merely shows an economy's general ability to pay for externalities such as social and environmental concerns.[23] Examples of externalities include:

- Wealth distribution – GDP does not account for variances in incomes of various demographic groups. See income inequality metrics for discussion of a variety of inequality-based economic measures.

- Non-market transactions–GDP excludes activities that are not provided through the market, such as household production and volunteer or unpaid services. As a result, GDP is understated. Unpaid work conducted on Free and Open Source Software (such as Linux) contribute nothing to GDP, but it was estimated that it would have cost more than a billion US dollars for a commercial company to develop. Also, if Free and Open Source Software became identical to its proprietary software counterparts, and the nation producing the propriety software stops buying proprietary software and switches to Free and Open Source Software, then the GDP of this nation would reduce, however there would be no reduction in economic production or standard of living. The work of New Zealand economist Marilyn Waring has highlighted that if a concerted attempt to factor in unpaid work were made, then it would in part undo the injustices of unpaid (and in some cases, slave) labour, and also provide the political transparency and accountability necessary for democracy. Shedding some doubt on this claim, however, is the theory that won economist Douglass North the Nobel Memorial Prize in Economic Sciences in 1993. North argued that the encouragement of private invention and enterprise due to the creation and strengthening of the patent system became the fundamental catalyst behind the Industrial Revolution in England.

- Underground economy–Official GDP estimates may not take into account the underground economy, in which transactions contributing to production, such as illegal trade and tax-avoiding activities, are unreported, causing GDP to be underestimated.

- Asset Value–GDP does not take into account the value of all assets in an economy. This is akin to ignoring a company's balance sheet, and judging it solely on the basis of its income statement.

- Non-monetary economy–GDP omits economies where no money comes into play at all, resulting in inaccurate or abnormally low GDP figures. For example, in countries with major business transactions occurring informally, portions of local economy are not easily registered. Bartering may be more prominent than the use of money, even extending to services (I helped you build your house ten years ago, so now you help me).

- GDP also ignores subsistence production.

- Quality improvements and inclusion of new products–By not adjusting for quality improvements and new products, GDP understates true economic growth. For instance, although computers today are less expensive and more powerful than computers from the past, GDP treats them as the same products by only accounting for the monetary value. The introduction of new products is also difficult to measure accurately and is not reflected in GDP despite the fact that it may increase the standard of living. For example, even the richest person from 1900 could not purchase standard products, such as antibiotics and cell phones, that an average consumer can buy today, since such modern conveniences did not exist back then.

- What is being produced–GDP counts work that produces no net change or that results from repairing harm. For example, rebuilding after a natural disaster or war may produce a considerable amount of economic activity and thus boost GDP. The economic value of health care is another classic example—it may raise GDP if many people are sick and they are receiving expensive treatment, but it is not a desirable situation. Alternative economic estimates, such as the standard of living or discretionary income per capita try to measure the human utility of economic activity. See uneconomic growth.

- Sustainability of growth– GDP is a measurement of economic historic activity and is not a necessarily a projection. A country may achieve a temporarily high GDP from use of natural resources or by misallocating investment.

- Nominal GDP doesn't measure variations in purchasing power or costs of living by area, so when the GDP figure is deflated over time, GDP growth can vary greatly depending on the basket of goods used and the relative proportions used to deflate the GDP figure.

- Cross-border comparisons of GDP can be inaccurate as they do not take into account local differences in the quality of goods, even when adjusted for purchasing power parity. This type of adjustment to an exchange rate is controversial because of the difficulties of finding comparable baskets of goods to compare purchasing power across countries. For instance, people in country A may consume the same number of locally produced apples as in country B, but apples in country A are of a more tasty variety. This difference in material well being will not show up in GDP statistics. This is especially true for goods that are not traded globally, such as housing.

- As a measure of actual sale prices, GDP does not capture the economic surplus between the price paid and subjective value received, and can therefore underestimate aggregate utility.

Simon Kuznets in his very first report to the US Congress in 1934 said:[4]

...the welfare of a nation can, therefore, scarcely be inferred from a measure of national income...

In 1962, Kuznets stated:[24]

Distinctions must be kept in mind between quantity and quality of growth, between costs and returns, and between the short and long run. Goals for more growth should specify more growth of what and for what.

Lists of countries by their GDP

- Lists of countries by GDP

- List of countries by GDP (nominal), (per capita)

- List of continents by GDP (nominal)

- List of countries by GDP (PPP), (per capita), (per hour)

- List of countries by GDP growth

- List of countries by GDP (real) growth rate, (per capita)

- List of countries by GDP sector composition

- List of countries by future GDP estimates (PPP), (per capita), (nominal)

List of Newer Approaches to the Measurement of (Economic) Progress

- Human development index (HDI) – up until 2009 report HDI used GDP as a part of its calculation and then factors in indicators of life expectancy and education levels. In 2010 the GDP component has been replaced with GNI.

- Genuine progress indicator (GPI) or Index of Sustainable Economic Welfare (ISEW) – The GPI and the ISEW attempt to address many of the above criticisms by taking the same raw information supplied for GDP and then adjust for income distribution, add for the value of household and volunteer work, and subtract for crime and pollution.

- Gross national happiness (GNH) – GNH measures quality of life or social progress in more holistic and psychological terms than GDP.

- European Quality of Life Survey – The survey, first published in 2005, assessed quality of life across European countries through a series of questions on overall subjective life satisfaction, satisfaction with different aspects of life, and sets of questions used to calculate deficits of time, loving, being and having.[25]

- Gross national happiness – The Centre for Bhutanese Studies in Bhutan is working on a complex set of subjective and objective indicators to measure 'national happiness' in various domains (living standards, health, education, eco-system diversity and resilience, cultural vitality and diversity, time use and balance, good governance, community vitality and psychological well-being). This set of indicators would be used to assess progress towards gross national happiness, which they have already identified as being the nation's priority, above GDP.

- Happy Planet Index – The happy planet index (HPI) is an index of human well-being and environmental impact, introduced by the New Economics Foundation (NEF) in 2006. It measures the environmental efficiency with which human well-being is achieved within a given country or group. Human well-being is defined in terms of subjective life satisfaction and life expectancy while environmental impact is defined by the Ecological Footprint.

- OECD Better Lives Dashboard - The better lives compendium of indicators produced in 2011 reflects some 10 years by the organisation to develop a wider of set of indicators more closed attuned to the measurement of wellbeing or welfare outcomes. There is felt to be considerable convergence (in 2011) in high income countries about the kinds of dimensions that should be included in such multi-dimensional approaches to welfare measurement - see for instance the capabilities measurement research project capabilities approach.

See also

Bibliography

Australian Bureau for Statistics, Australian National Accounts: Concepts, Sources and Mathods, 2000. Retrieved November 2009. In depth explanations of how GDP and other national accounts items are determined.

United States Department of Commerce, Bureau of Economic Analysis, Concepts and Methods of the United States National Income and Product AccountsPDF. Retrieved November 2009. In depth explanations of how GDP and other national accounts items are determined.

References

- ^ Based on the average of the IMF and WorldBank numbers as stated in List_of_countries_by_GDP_(nominal)_per_capita on 17 December 2011. I only used numbers from 2009 or 2010. If no number was available for a country from IMF or WorldBank, I used the CIA numbers.

> $102 400$51 200 - $102 400$25 600 - $51 200$12 800 - $25 600$6 400 - $12 800$3 200 - $6 400$1 600 - $3 200$800 - $1 600$400 - $800< $400unavailable

- ^ O'Sullivan, Arthur.

- ^ French President seeks alternatives to GDP, The Guardian 14-09-2009.

European Parliament, Policy Department Economic and Scientific Policy: Beyond GDP StudyPDF (1.47 MB) - ^ a b Congress commishened Kuznets to create a system that would measure the nation's productivity in order to better understand how to tackle the Great Depression Simon Kuznets, 1934. "National Income, 1929–1932". 73rd US Congress, 2d session, Senate document no. 124, page 7. http://library.bea.gov/u?/SOD,888

- ^ World Bank, Statistical Manual >> National Accounts >> GDP–final output, retrieved October 2009.

"User's guide: Background information on GDP and GDP deflator". HM Treasury. http://www.hm-treasury.gov.uk/data_gdp_backgd.htm.

"Measuring the Economy: A Primer on GDP and the National Income and Product Accounts" (PDF). Bureau of Economic Analysis. http://www.bea.gov/national/pdf/nipa_primer.pdf. - ^ United States Bureau of Economic Analysis, A guide to the National Income and Product Accounts of the United StatesPDF, page 5; retrieved November 2009. Another term, "business current transfer payments," may be added. Also, the document indicates that Capital Consumption Adjustment (CCAdj) and Inventory Valuation Adjustment (IVA) are applied to the proprieter's income and corporate profits terms; and CCAdj is applied to rental income.

- ^ Thayer Watkins, San José State University Department of Economics, "Gross Domestic Product from the Transactions Table for an Economy", commentary to first table, " Transactions Table for an Economy". (Page retrieved November 2009.)

- ^ Concepts and Methods of the United States National Income and Product Accounts, chap. 2.

- ^ BEA, Concepts and Methods of the United States National Income and Product Accounts, p 12.

- ^ Australian National Accounts: Concepts, Sources and Methods, 2000, sections 3.5 and 4.15.

- ^ This and the following statement on entitlement to compensation are from Australian National Accounts: Concepts, Sources and Methods, 2000, section 4.6.

- ^ Concepts and Methods of the United States National Income and Product Accounts, page 2-2.

- ^ Concepts and Methods of the United States National Income and Product Accounts, page 2-2.

- ^ Australian National Accounts: Concepts, Sources and Methods, 2000, section 4.4.

- ^ Concepts and Methods of the United States National Income and Product Accounts, page 2-2; and Australian National Accounts: Concepts, Sources and Methods, 2000, section 4.4.

- ^ a b Concepts and Methods of the United States National Income and Product Accounts, page 2-4.

- ^ Concepts and Methods of the United States National Income and Product Accounts, page 2-5.

- ^ Lequiller, François; Derek Blades (2006). Understanding National Accounts. OECD. p. 18. ISBN 978-92-64-02566-0. http://books.google.co.uk/books?id=pXpJL6f8b3wC&printsec=frontcover&dq=%22Understanding+National+Accounts%22&source=bl&ots=_6_lHq-McY&sig=YqWljozkylpi4IFspFnjGwPicPw&hl=en&ei=4g7GTLT7OJCQjAfXiZ11&sa=X&oi=book_result&ct=result&resnum=5&ved=0CCMQ6AEwBA#v=onepage&q=%22To%20convert%20GDP%20into%20GNI%22&f=false. "To convert GDP into GNI, it is necessary to add the income received by resident units from abroad and deduct the income created by production in the country but transferred to units residing abroad."

- ^ United States, Bureau of Economic Analysis, Glossary, "GDP". Retrieved November 2009.

- ^ "U.S. Department of Commerce. Bureau of Economic Analysis". Bea.gov. 2009-10-21. http://bea.gov/national/nipaweb/SelectTable.asp?Selected=Y. Retrieved 2010-07-31.

- ^ "National Accounts". Central Bureau of Statistics. http://www.central-bureau-of-statistics.an/SNA/sna_intro.asp. Retrieved 2011-06-29.

- ^ HM Treasury, Background information on GDP and GDP deflator

Some of the complications involved in comparing national accounts from different years are suggested in this World Bank document. - ^ "Eric Zencey-G.D.P. R.I.P.". Nytimes.com. August 2009. http://www.nytimes.com/2009/08/10/opinion/10zencey.html?_r=4&pagewanted=1&emc=eta1. Retrieved 2011-01-31.

- ^ Simon Kuznets. "How To Judge Quality". The New Republic, October 20, 1962

- ^ "First European Quality of Life Survey". http://www.eurofound.europa.eu/publications/htmlfiles/ef0591.htm.

External links

Global

- World GDP Chart (since 1960)

- Australian Bureau of Statistics Manual on GDP measurement

- GDP-indexed bonds

- GDP scaled maps

- Euro area GDP growth rate (since 1996) as compared to the Bank Rate (since 2000)

- World Development Indicators (WDI)

- Economist Country Briefings

- UN Statistical Databases

- Is Life Getting Better : What is GDP? Pamphlet describing the basic idea of GDP, from OECD's Measuring Progress project.

Data

- Thermal Maps of the World Nominal GDP in US$ purchasing power parity from the EIU 2007–2010

- Bureau of Economic Analysis: Official United States GDP data

- Historicalstatistics.org: Links to historical statistics on GDP for different countries and regions

- Historical US GDP (yearly data), 1790–present

- Historical US GDP (quarterly data), 1947–present

- OECD Statistics

- Google – public data: GDP and Personal Income of the U.S. (annual): Nominal Gross Domestic Product

Articles and books

- What's wrong with the GDP?

- Limitations of GDP Statistics by Schenk, Robert.

- whether output and CPI inflation are mismeasured, by Nouriel Roubini and David Backus, in Lectures in Macroeconomics

- Fengbo Zhang – the founder of China GDP

- Chapter 22 of Dr. Roger A. McCain's Essential Principles of Economics: A Hypermedia Text

- Rodney Edvinsson, Growth, Accumulation, Crisis: With New Macroeconomic Data for Sweden 1800–2000PDF

- Clifford Cobb, Ted Halstead and Jonathan Rowe. "If the GDP is up, why is America down?" The Atlantic Monthly, vol. 276, no. 4, October 1995, pages 59–78.

- Jerorn C.J.M. van den Bergh, "Abolishing GDP"

|

|||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||